life insurance policy for parents

Whole Life Insurance It is a comprehensive form of life insurance that provides. Yes you can purchase life insurance for your parents.

Why Life Insurance For Parents Is Essential

According to my younger sister my narcissistic mother is now the policyholder and is cashing in on it.

. This may be the result of a disability or. The most common types of life insurance policies children buy for their parents include the following. Youll want your life insurance policy to take effect before your baby is born which means you should purchase it at least four to six weeks prior to your babys due date to allow sufficient.

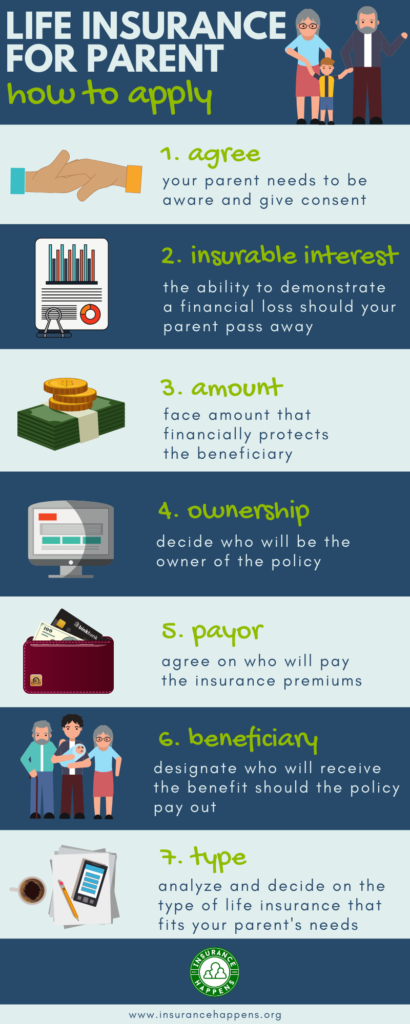

In order to purchase a life insurance policy on your parents. The Best Life Insurance For Parents From 792 a Month 2022 Life Insurance For Parents Shawn Plummer CEO The Annuity Expert When it comes to life insurance parents have a few. Term life insurance pays a death payout but has no monetary value.

Say your parents are in their. A life insurance policy is a good way to earmark money specifically for their funeral or related costs. If you are married and both you and your spouse have full coverage under your parents insurance policy you should be able to stay on that coverage.

Its your responsibility to maintain the policies you hold and ensure that your chosen beneficiaries have the correct information should they ever need to claim. Make your beneficiaries aware. In addition they only cover the insured for a set period.

If the premium has. These policies usually build cash value and do not stop covering you after a certain time frame. For example you may buy a 250000 term life.

However it can be difficult to take out a life insurance policy on someone other than yourself even if that person is related. Generally a guaranteed universal life. Covering your parents debts No one wants to pass down an inheritance of debt but.

You may choose a whole life insurance policy as a young parent if you have a child that likely has to depend on you financially for the rest of their life. Its always necessary for your parent to agree to the life insurance policy. You can purchase a cash-value policy when youre young and single then add a term life policy when you get married and have.

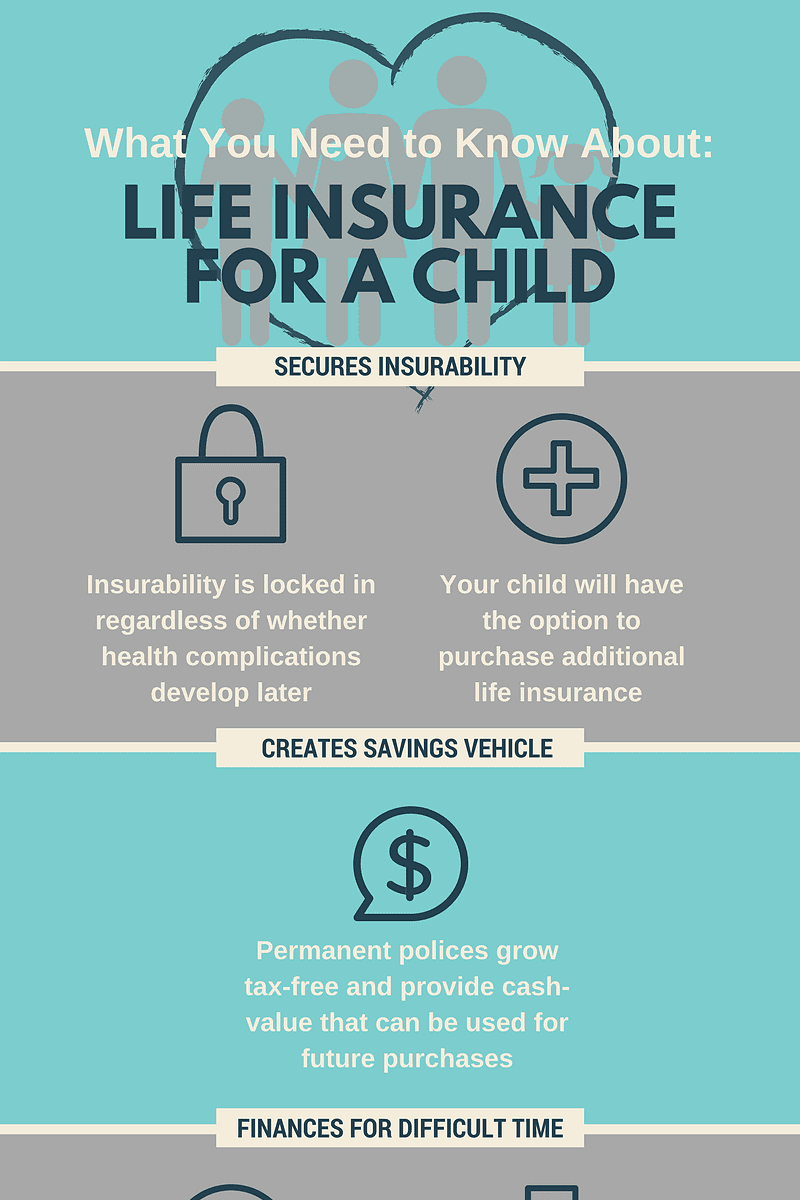

Whole life insurance is typically the best option for parents near or after retirement. The short answer is yes. In this article we explain the life insurance policies that parents buy for their children the logistics of transferring the policy from parent to child and what you can do if.

The best life insurance to buy for your parents depends on their health age and your financial situation. There are two types of life insurance for parents term life insurance and permanenIn addition permanent life insurance policies accumulate cash value a feature that term policies dont have. The cash valu See more.

In this 5 step guide to life insurance for parents we explain what you need to do to ensure your benefits go to your deserving loved ones. Buying life insurance isnt an either-or proposition. So my grandpa took a life insurance policy out on me when I was a baby.

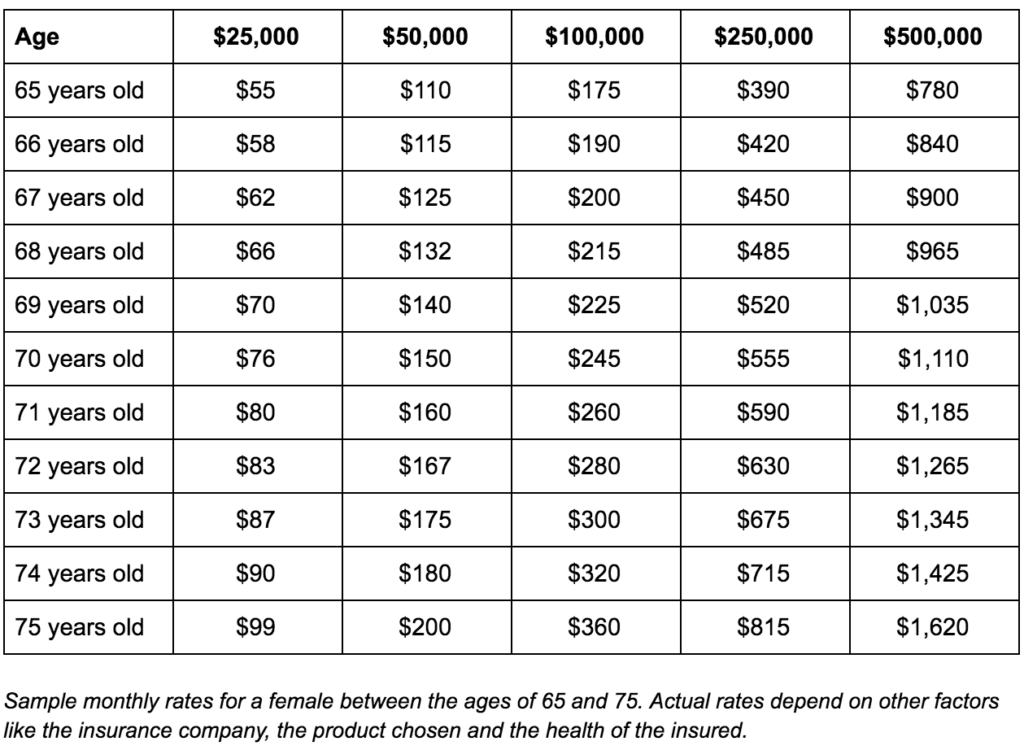

The cost of life insurance depends on the type of policy coverage amount term length and riders plus your parents age health and other factors. Best life insurance for a parent. In order to purchase life insurance for a parent or on anyone for that matter you must have consent.

If your parent was still paying premiums on their life insurance policy you may be able to find records of checks or electronic payments in their recent bank statements. The cash value grows with each premium payment and as the policyholder you can withdraw or borrow the money. Life insurance for parents over 50 comes with a term of 10 to 30 years with pure benefits of death.

You can take out life insurance on your parents lives if they are direct family members and you share a bond of love. Guaranteed Acceptance Life insurance to provide a limited amount of coverage.

Guide To Buying Life Insurance For Parents Elderly Burial

Buying Life Insurance For Parents Policy Options Aafmaa

Why Life Insurance For Parents Is Essential Life Insurance Quotes Life Insurance Companies Homeowners Insurance

How To Choose Life Insurance Plans According To Your Income

10 Tips For Buying Life Insurance For Parents Avoid Taxes

Quility Insurance For All Those New Parents Out There Looking To Catch Some Zzz S Tonight Here S How A Life Insurance Policy Can Help You Get Peace Of Mind And Sleep More

Life Insurance For Parents And How To Apply

Life Insurance It S Life Or Debt For Generation X Independent Ie

Talking To Your Adult Kids About Life Insurance Quotacy

Did Your Parents Give You A Whole Life Insurance Policy Here S What To Do With It

.jpg)

The 5 Biggest Life Insurance Mistakes Parents Are Making In 2021 Policyme

Family Life Insurance And Policy Stock Photo Image Of Parents Policy 35426120

Buying Life Insurance For Parents

10 Mistakes When Buying Life Insurance For Your Parents Glg America

What You Need To Know About Children S Life Insurance Infographic

Permanent Life Insurance Whole Life Policy Knights Of Columbus

Advice For Buying Life Insurance On Your Parents

4 Factors To Consider While Buying Life Insurance Plan For Parents